Over the past few years, the number of startups incorporated has ballooned -- when launching a startup, many are cash constrained yet face a myriad of legal challenges, ranging from incorporation to day to day nuances around hiring, firing, issuing board consents, etc.

I’ve seen plenty of mistakes made by founders during my time at Atrium where we helped over 1,000 startup founders incorporate and raise early financings.

And I can’t stress enough on how common these were yet could have been detrimental if not caught — ie. issuing the wrong amount of equity to hires, incorporating incorrectly which prevents fundraising success, etc. etc.

These mistakes are made at the initial formation, in the early stages of growth, and at scale when hiring employees - unfortunately this is when you can make costly mistakes that affect ownership and success in fundraising.

The following are some of the most common and costly legal considerations and mistakes to watch out I’ve seen for founders when gearing up to start a venture backed company. I break down the general steps for each in their respective sections below - hopefully this brings much needed transparency for you when navigating discussions with perspective lawyers.

FLIP

SAFE

Convertible Note

Issuing Board Consents

Hiring/Firing

FLIP

What is a Delaware FLIP?

A Delaware FLIP is the process of converting an entity (C-Corporation, LLC, etc.) into a Delaware C-Corp. A Delaware FLIP typically involves either:

A "conversion" - converting a predecessor entity from DE into a Delaware C-Corp (a single entity transaction - e.g., converting a DE LLC into a DE C-Corp)

A "redomestication" - converting a predecessor entity from another state into a Delaware C-Corp (also a single entity transaction - e.g., converting an NY LLC or C-Corp into a DE C-Corp), or

An "inter-entity merger" - creating a new Delaware C-Corp and merging a predecessor entity into the new corporation (e.g., merging a CA C-Corp into a DE C-Corp, because CA does not allow the above options for C-Corps)

What route you take for a FLIP depends in part on the location of the predecessor entity and whether there is a statute in that jurisdiction that allows you to take one of the simpler routes ((i) or (ii) above) vs. doing a FLIP via an inter-entity merger.

Why would you FLIP to a Delaware C-Corp?

To make your company attractive to the broadest range of investors.

Most U.S. venture funds will only invest in Delaware C-Corps, because Delaware provides the most comprehensive corporate legal code, which allows them to replicate standard structures/terms and to be comfortable on how a court would apply the law to their investment entities. In addition, some venture firms are prohibited from investing in other types of non-corporate entities (e.g., LLCs and other tax “pass-through” entities, where the entity’s owners are taxed directly on the entity’s income, taking into account their share of the profits and losses on their individual tax returns).

So, to be safe and to not scare off investors, it can be a worthy consideration to have your company be a DE C-Corp.

How long does it take? - Note, these times can vary based on the factors below!

When should you NOT FLIP?

If you are an LLC and (i) are a single owner or only have a few partners and/or (ii) do not need to issue equity in order to attract/retain employees, it may make sense to retain the “pass-through” tax treatment that an LLC provides. For both LLCs and corporations, if you do not need to join an accelerator or attract venture capital in the near future, then you do not strictly need to do a FLIP.

Also, in the unlikely event that there is no real IP and no assets/liabilities in your current company, you could consider dissolving the current entity and starting fresh.

Why does it cost so much to FLIP ?

Per the above, there are different ways to structure a FLIP, and a lot of the legal work and time goes into figuring out the best way to structure a FLIP in your particular circumstances to confirm:

the law in the state/country permits the FLIP as-structured,

whether the FLIP structure trips any restrictions on assignment in the predecessor entity’s contracts (as certain FLIPs involve an assignment to the successor corp),

that stakeholder shares convert correctly between companies, and

the tax consequences around the share conversion and transferring various ownership interests, assets/liabilities, and IP in the FLIP.

The tax consequences are very important in a FLIP, because if done incorrectly the individual stakeholders involved could face personal tax, which of course you always want to avoid. There can also be consequences for the tax treatment of the stock, which tax counsel can provide more insight into, depending on the tax structure of the flip.

More on the process associated with completing a FLIP:

Preliminary Matters:

Structuring

Drafting and Executing Documents

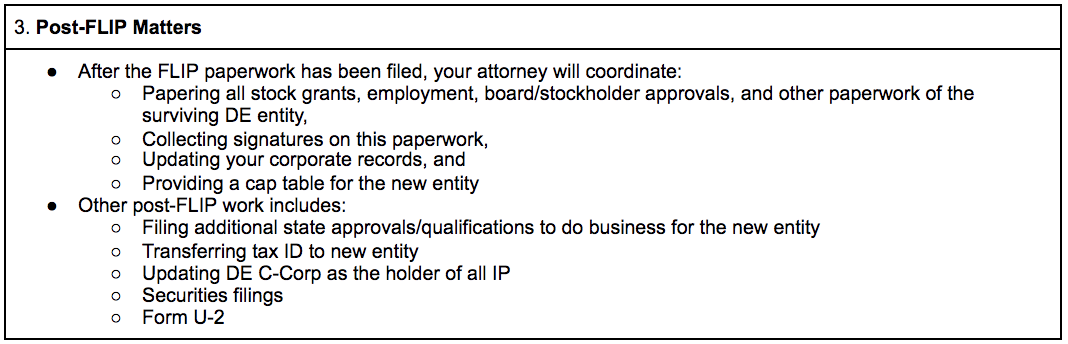

Post-FLIP Matters

SAFE Financing

What is a SAFE?

A “SAFE” stands for a Simple Agreement for Future Equity. A SAFE is structured to work like convertible debt (i.e., money invested now in exchange for the promise of it converting into preferred stock (most of the time) upon certain triggering events later), but it is not viewed as debt because it does not have (i) a maturity date or (ii) an interest rate.

So, under the standard form of SAFE, the company is only on the hook for the value of the SAFE (no interest rate) and will typically not be forced to pay the investor back unless and until the SAFE converts (no maturity date).

What is a SAFEs vs. Convertible Debt

Unlike convertible debt, the SAFE was actually designed not to be paid back unless and until the company has the ability to do so, usually in connection with a financing or sale of the company (or another variety of change in control, if the company goes out of business, or upon an IPO). The lack of a drop dead maturity date in a SAFE means the investor does not have the ability to require a repayment of their investment (and potentially hold the company hostage if they are not repaid).

The SAFE structure better reflects Silicon Valley investors’ intent in lending money to very early stage companies vs. a convertible loan/debt -- basically, investors are not expecting to get paid back or to realize any return on their investment unless a portfolio company is successful.

So, SAFEs are a founder-friendly alternative to issuing convertible debt. In exchange for the heightened risk that investors are taking on in purchasing a SAFE vs. convertible debt, SAFEs usually provide investors with (i) a valuation cap and/or discount rate (so that the investors pay less per share than investors who only participate in the equity financing) and sometimes (ii) “pro rata rights” to participate in future equity financings of the company.

NOTE: A valuation cap is not necessarily the value of the company today (your lawyer will help guide you to an informed decision about a proper valuation cap).

When should I use a SAFE?

Most founders choose to raise their initial “seed” rounds on SAFEs as a founder-friendly alternative to raising a convertible note (and a much cheaper, faster and more simple structure than a full-blown equity financing). SAFEs are also easier to execute as they are short, standardized, and there are fewer things to negotiate.

What are the most important terms in a SAFE?

The principal business terms negotiated in a SAFE round are typically (i) whether the SAFE is a post-money SAFE (new YC Form, generally more investor-favorable) or a pre-money SAFE (old YC Form, generally more company-favorable) (i) the valuation cap and/or discount rate, which relate to the price at which the SAFE will ultimately convert into capital stock, (ii) the existence of an Most Favored Nation clause (“if you give better terms to another investor after I sign this, then I get those terms as well”), and (iii) the existence of pro rata rights. There are other more technical legal terms that your lawyer can help you negotiate as well.

What work is involved in executing a SAFE?

Timeframe: The time spent on executing a SAFE is around 1-2 weeks, depending on level of negotiation and number of investors, but oftentimes SAFE investments are taken in over an extended period of time to fund the early stages of a business’s ideation and growth. Larger numbers of investors can also greatly prolong the timing and the process can quickly turn into a herding cats scenario if not managed well (by the client).

Convertible Note Financing

A convertible note financing involves the issuance of “convertible” notes in return for capital. The notes are convertible because they convert into capital stock of the company (or are repaid) upon the occurrence of certain triggering events. These triggers are negotiated with participating investors and the company - the most common ones include a qualified financing, the note hitting its maturity date, and/or a change of control. Convertible notes are a loan/debt instrument because they have a date of maturation and an interest rate (unlike a SAFE), though they are still considered a security because of their ability to convert.

When do you use a convertible note?

Convertible notes have fallen out of style somewhat in favor of the more founder-friendly alternative of a SAFE. However, convertible note financings are still much cheaper and more simple structure than a full-blown equity (preferred stock) financing. Note financings are typically used for investors that prefer to invest in a note structure (or is not familiar with Silicon Valley investments), or for much larger or riskier rounds where investors want some guarantee of being repaid with interest.

It is important to understand that using a note means that there will be debt on the company’s books, and that the investments will be repayable with interest upon maturity.

What are the most important terms in a convertible note?

The principal business terms negotiated in a convertible note round are typically the (i) valuation cap and/or discount, which relate to the price at which the note will convert, (ii) interest rate, (iii) maturity date, (iv) existence of an MFN, and (v) existence of pro rata rights, which are less common in note rounds because notes are less risky for investors than SAFEs. There are other more technical legal terms that your lawyer will help you negotiate as well, which are often negotiated at the document (rather than term sheet) level.

What work is involved in executing a Convertible Note?

Issuing Board Consents

What is a board consent?

Corporate law requires that certain actions taken by the company be approved by the board of directors. Most of these are major strategic actions, or actions that would impact the company’s financials, cap table, governance (e.g., board/officers), or stockholders. The board is subject to fiduciary duties that require decisions be made carefully/in good faith (the duty of care) and in the company’s best interests (the duty of loyalty).

How do you get board consent?

It can be done via unanimous written consent or a majority vote at a meeting (memorialized in board minutes).

Hiring/Firing

Thank you Jason Kornfeld (the real lawyer here!) for edits and feedback :) His speciality is serving early stage founders; at Atrium he covered all YC companies - it goes without saying that he is my go to regarding everything legal for early stage startups.