Imagine a fintech market - one that processes $25 trillion of payments every year in the U.S. alone. Now imagine that the leading company in that market, with 42% market share, is a company founded in 1850 whose product has been largely stagnant for the past few decades.

*Cue investors opening checkbooks*

That fintech market is B2B payments, the market leader is AMEX, and the VC money is flowing just as rapidly as you’d expect. No less than 5 companies - Brex, Divvy, Ramp, Airbase, and Teampay - are taking aim at AMEX just like Netflix once took aim at Blockbuster.

A spend management war is brewing, and there are lots of questions in the air. Only a few weeks ago, Ramp announced a fresh $30M round of funding and yesterday, Divvy announced a $165M funding round. What really differentiates these companies from each other? Can they really beat the incumbents? Who’s winning now, and what are the key strategic factors going forward?

Well, we’re glad you asked. Let’s dive in.

You probably don’t need to be persuaded that this is a staggeringly large market, but just for fun, here are the numbers: Annual B2B payment volume currently sits at $127T and is expected to reach $200T by 2028 - the U.S. accounts for roughly 20% of this volume (IDC Research). Note that this purchase volume is larger than GDP.

The Promise of Integration

We opened by discussing the payment rails side, since those are the companies which get a slice of the massive purchase volume we just saw. But a company which provides only the raw payment rails doesn’t really add much value - companies are looking to spend money better in a more controlled and focused way. So this new crop of companies also compete in the spend management space to address this need.

The problem of spend management is an old one, but becoming increasingly more complex. With remote and hybrid work as the future of the workforce, business purchasing is becoming increasingly decentralized. There’s been a 12x increase in the number of software buyers in SMB and mid market companies. Moreover, with the SaaS explosion, businesses are spending on a greater variety of products, touching all parts of their operations. With more spenders and more things to spend on, managing it all becomes harder and harder.

And what do the existing solutions look like? Concur (acquired by SAP for $8.3B in 2014) is the clear leader in spend management and has been for quite a while - but they ceased innovating long ago and are now just resting on their laurels as they address enterprise customers. The product UI is antiquated, G2Crowd reviews are subpar at best, and despite all this, they hold a whopping 51% of the market.

The new companies say they can do better. They sit at the intersection of corporate cards and expense management, which allows them to offer lots of appealing features:

User friendly software directly integrated with the cards themselves. Software can now control and approve payments anytime a card is swiped.

Automated expense reports with real time spend tracking and enforcement

Virtual cards with enhanced oversight and security features

Highly competitive pricing models and incentives

And all this functionality builds up to a grand promise for finance teams: transparency, control, and smooth operating flows.

These players can be mapped as such below -- they offer real time visibility (which the antiquated solutions do not offer) and have created intuitive, employee-first experiences. Over time, expect the disruptors to start moving left into the AP/AR space to capture more margin.

Of course, different customer segments value different parts of this spectrum:

What about float? Capital-intensive or cash-flow-sensitive businesses are more likely to choose a charge card (which provides a 30 or 60-day loan) rather than a debit card (which requires you to load up funds before spending). Brex, Divvy, and Ramp are charge cards; Airbase and Teampay are debit cards.

What will it take to win?

The intriguing thing about this space is that the sheer size of the available purchase volume will produce innovation in every area adjacent to it. Spend management is the first and most obvious place to add value, but once these companies have built modern, comprehensive solutions for that problem, it’s anyone’s guess how they will next try to differentiate themselves.

A fintech CEO recently tweeted that the story of Silicon Valley is that “a new company shows up, and everyone thinks it'll eat the incumbents' lunch - and then 10 years later we realize there's SO MUCH MORE LUNCH than we ever imagined.”

In that spirit, the key to long-term victory will be to find enormous heaps of “lunch” - existing financial systems and processes which modern software can make faster, easier, or more powerful.

But in the short term, the most important thing is to out-execute everyone else. Here’s what that looks like in detail:

Software first - The raw financial payment rails are destined to be commoditized, so having the most feature-complete software in the market provides a strong advantage. In addition to the features in the chart above, it’s incredibly important to build strong integrations with accounting and payroll systems, so as to minimize switching costs for customers.

Scalable GTM motion - The best companies will have a competitive pricing model while also controlling CAC at scale. This means finding a low touch growth strategy to service small companies while building out a robust sales motion for later stage ones.

Own the entire financial stack - This lesson has been re-learned in countless industries. In this case, there are actually two stacks involved:

The Accounts Payables/BillPay stack: Some of these spend management companies (see chart below) use WEX or CPayPlus under the hood - but this setup produces long delays on billing and invoicing.

The card issuing stack: Marqeta is a common choice here, and it’s great for getting started - but at scale these companies will want to build their own issuing capabilities in order to capture additional transaction data and secure higher interchange rates for themselves (interchange is a fee that a merchant is required to pay to the card company with every payment transaction - usually it's around 2%).

Robust but flexible underwriting - One of the first ways Brex differentiated itself from the incumbents was the ability to underwrite their customers without relying on founders’ personal credit. Now Ramp and Divvy offer cash-based underwriting too, and Brex has expanded into a 60-day product and inventory-based underwriting. Supporting multiple underwriting strategies helps to unlock new customer segments and enhances the appeal to cash-flow-conscious CFOs - but it requires careful risk management to avoid heavy losses.

Pricing and incentives - Many of these companies are free to use (they make money off of interchange fees). But it’s really hard to scale revenue with just this one stream. The best companies will figure out a way to monetize through other pricing channels. Airbase does this well already: they charge SaaS pricing (tiered based on monthly spend, freemium for smaller companies) in addition to interchange. The CFOs I talked with were more than happy to pay this SaaS fee, because the “rewards they earn back” are greater than the monthly price they pay out. Ramp is reportedly developing their own SaaS fee, and will likewise need to ensure that their customers don’t feel any negative emotions about paying more as they scale.

Direct Comparison

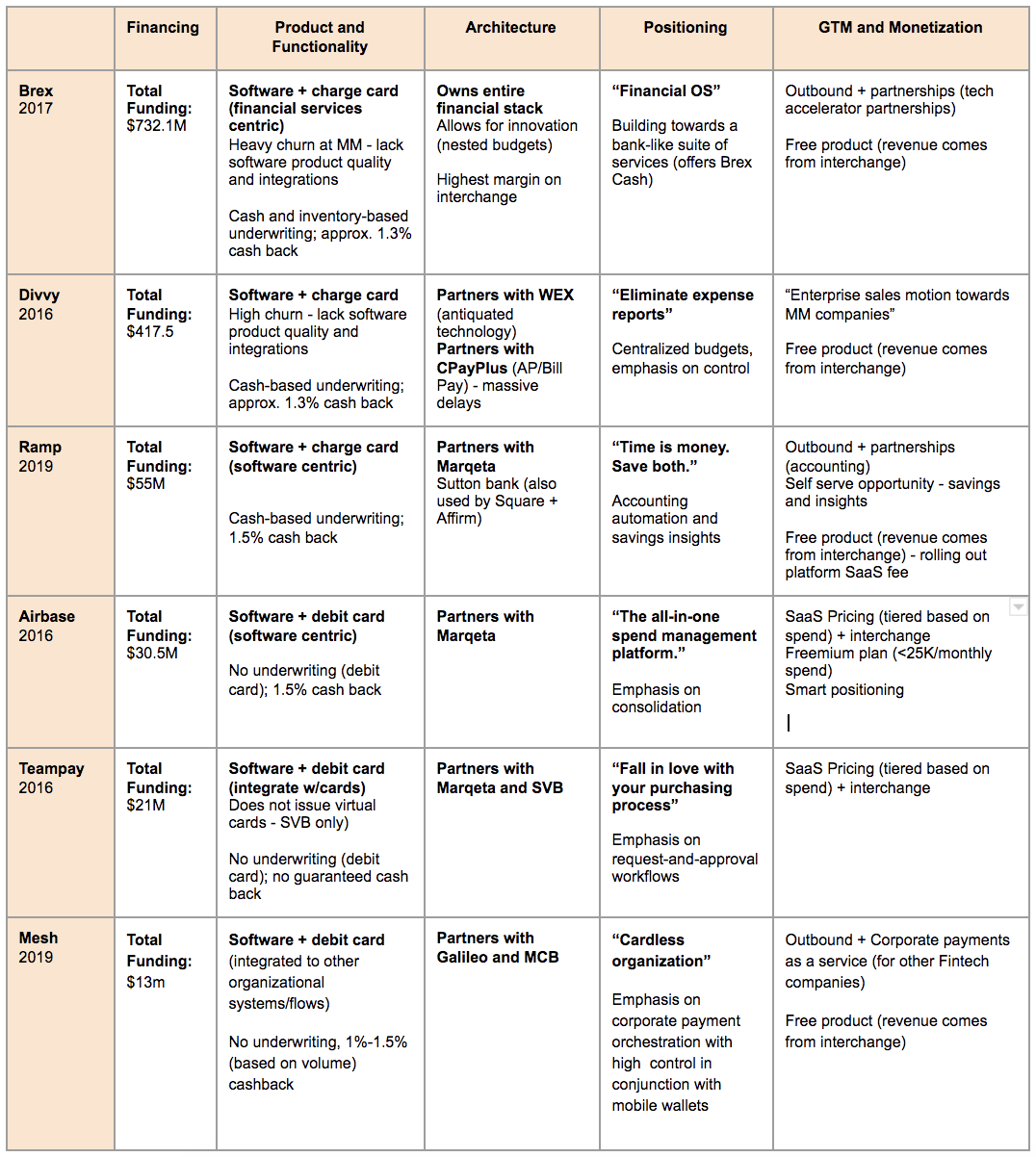

The moment you’ve been waiting for: a chart where our 5 startups can face off head-to-head!

Interestingly, these startups each emphasize a different part of the spend management problem. In the end, the winners will likely end up being good at most or all of these aspects, but at this stage they’ve each carved out one or two to focus on.

As evidenced by the existing corporate card companies, this is not a winner-take-all market (switching costs are high) -- so expect to see 1-2 leaders emerge. What we see today is Airbase and Ramp vying for the lead in terms of product quality (Airbase has procurement features baked in, while Ramp has the most complete card product). But Brex and Divvy have raised the most funding and have the largest existing customer bases, so expect them to remain competitive as well.

There’s a long way to go before any of these companies take down AMEX or Concur. Combined, they still only have 2-3 bps of market share. But that’s how new technology always starts, now isn’t it?

———

Thank you for Charley Ma, Kevin Zhang, Josh Coyne for providing feedback on drafts of this post.

Follow them on Twitter here: @CharleyMa, @kevinzhang, @josh_coyne

Disclosure: Lisa is an advisor to Ramp and Calvin is an employee at Ramp.